Fairview Funds

Distressed Investing Throughout the Economic Cycle

Every phase of the economic cycle yields distressed opportunities.

Global uncertainty regarding asset prices can certainly prompt seller-side panic and deep discounts, but so can inefficient capital structures, sponsor-driven distress, and asset-level difficulties even in stronger markets. Our process is hyper-focused on mitigating risks of all kinds.

At Fairview, we are experts at “pricing a problem” based on our decade of experience, and are able to do so effectively across a broad range of asset types and locations.

Our mix of acquisitions vs. originations will naturally vary throughout the economic cycle, but our focus on limited downside with expansive upside remains constant.

Our aim is first and foremost to preserve investor capital, and we work each deal actively throughout the investment cycle to limit downside while creating expansive upside.

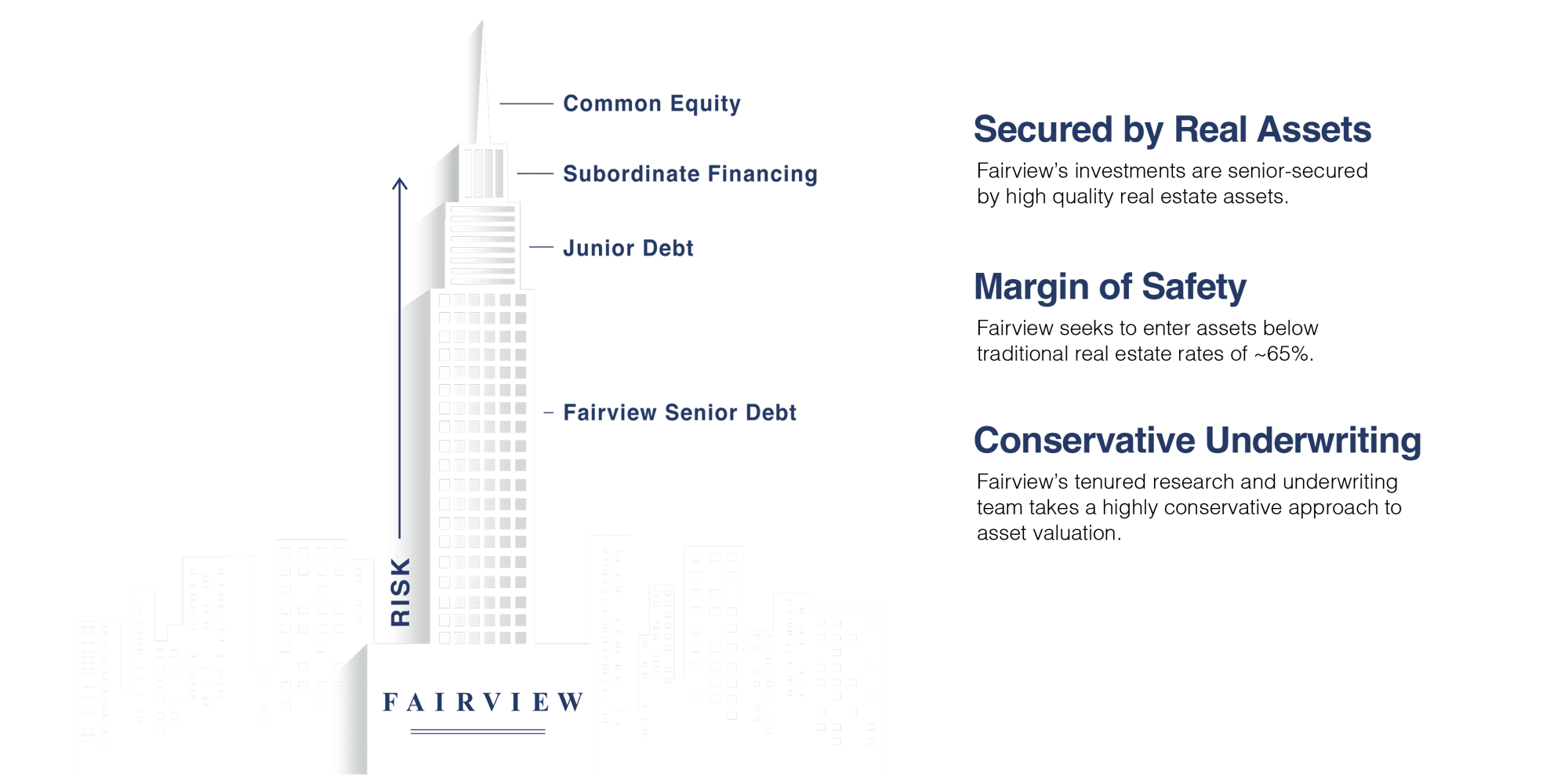

Commitment to Capital Preservation

Performance

Data as of 9/30/2025

| Fund | Phase | Contributed Capital | Cumulative LP Distributions |

|---|---|---|---|

| Fairview Investment Fund I, LLC | Fully Resolved | $15,032,711 | $25,186,137 |

| Fairview Investment Fund II, LP | Fully Resolved | $27,405,800 | $40,943,992 |

| Fairview Investment Fund III, LP | Fully Resolved | $26,059,685 | $26,998,580 |

| Fairview Investment Fund IV, LP | Resolution Phase | $38,102,399 | $49,120,689 |

| Fairview Investment Fund V, LP | Resolution Phase | $81,896,951 | $72,819,863 |

| Fairview Investment Fund VI, LP | Resolution Phase | $32,669,694 | $15,351,599 |

| Fairview Investment Fund VII, LP | Active Investment Phase | $21,728,794 | $2,841,977 |

Performance results are net of fees and expenses. No assurance can be given that a Fairview fund’s investment strategy will be profitable, and a substantial risk exists that losses and expenses will exceed income and gains. Each fund is a newly formed entity with no performance record. As is true of any investment in illiquid assets where information regarding its investments may not be reliable and is limited, there is a risk that an investment in any Fairvew fund will be lost entirely or in part. Fairview funds are not a diversified investment program and should only represent a small portion of an investor’s portfolio.